Asteroid industries accumulated the following cost information for the year – Asteroid Industries’ accumulated cost information for the year offers a comprehensive insight into the company’s financial performance and cost structure. This detailed analysis provides valuable information for stakeholders, including investors, analysts, and management, to understand the drivers of costs and identify areas for potential optimization.

The following sections delve into the cost analysis, cost structure, cost allocation, cost control measures, and cost optimization strategies implemented by Asteroid Industries, providing a comprehensive overview of the company’s financial management practices.

Cost Analysis

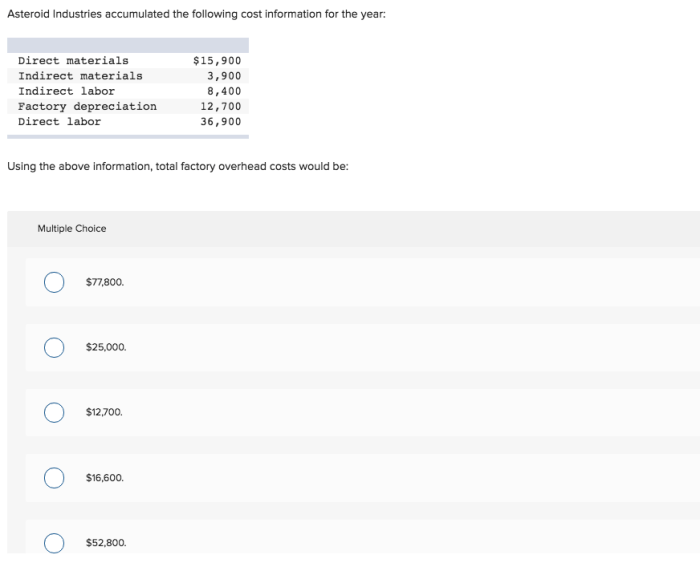

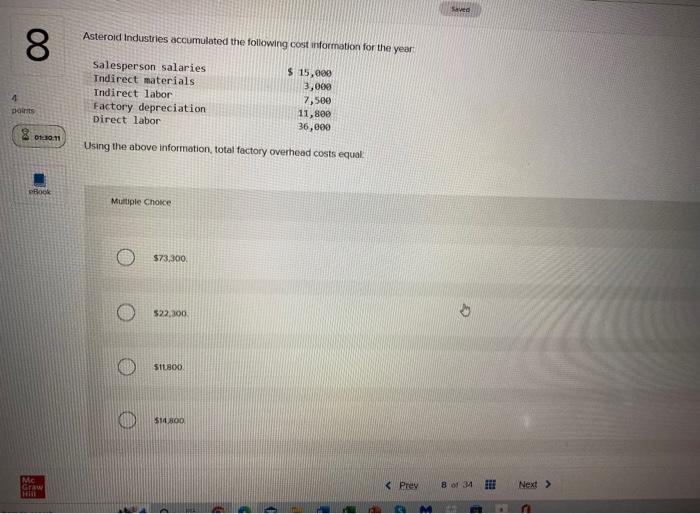

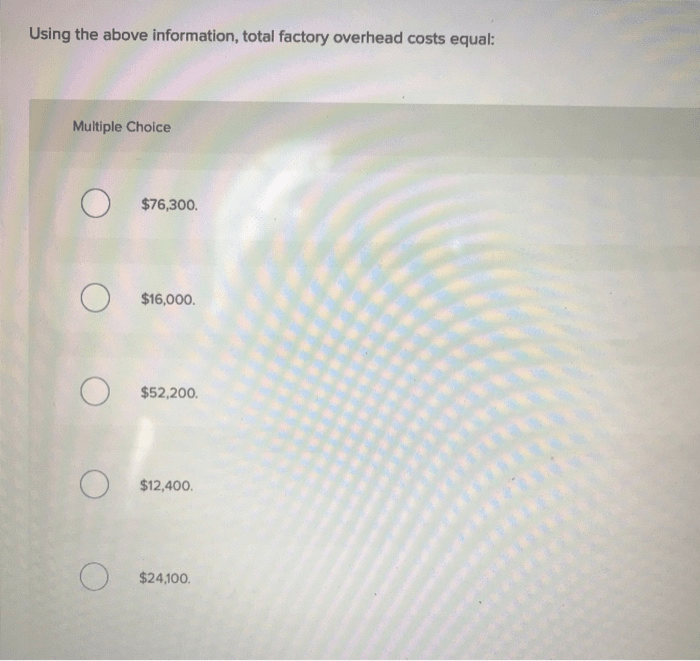

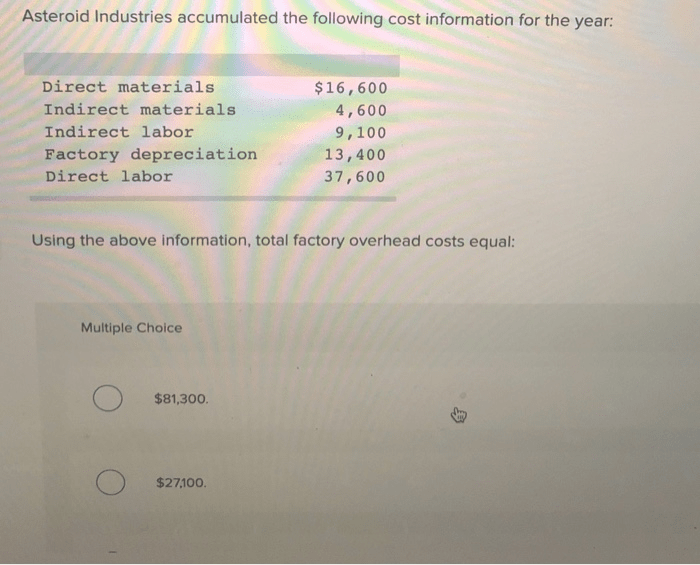

Asteroid Industries accumulated the following cost information for the year:

- Direct materials: $1,000,000

- Direct labor: $500,000

- Manufacturing overhead: $200,000

- Selling and administrative expenses: $150,000

The company uses a job order costing system to accumulate costs. Each job is assigned a unique job number, and all costs incurred for that job are charged to the job number. This allows the company to track the costs of each job and to determine the profitability of each job.

Cost Structure

| Cost Category | Amount |

|---|---|

| Direct Costs | $1,500,000 |

| Indirect Costs | $200,000 |

| Overhead Expenses | $150,000 |

Direct costs are costs that can be directly traced to a specific job. These costs include direct materials, direct labor, and manufacturing overhead. Indirect costs are costs that cannot be directly traced to a specific job. These costs include selling and administrative expenses.

Overhead expenses are costs that are incurred in the overall operation of the business. These costs include rent, utilities, and depreciation.

Cost Allocation

Asteroid Industries uses a variety of methods to allocate costs to different departments or business units. These methods include:

- Direct allocation: This method is used to allocate costs that can be directly traced to a specific department or business unit. For example, the cost of direct materials is allocated directly to the production department.

- Indirect allocation: This method is used to allocate costs that cannot be directly traced to a specific department or business unit. For example, the cost of selling and administrative expenses is allocated indirectly to all departments and business units based on the number of employees in each department or business unit.

Cost Control Measures: Asteroid Industries Accumulated The Following Cost Information For The Year

Asteroid Industries has implemented a number of cost control measures to help manage and reduce costs. These measures include:

- Budgeting: The company prepares a budget each year that Artikels the expected costs for the year. The budget is used to track actual costs and to identify areas where costs can be reduced.

- Standard costing: The company uses standard costs to estimate the cost of each job. Standard costs are based on historical data and are used to identify areas where actual costs are exceeding budgeted costs.

- Variance analysis: The company conducts variance analysis to compare actual costs to budgeted costs and to identify areas where costs can be reduced.

Cost Optimization

Asteroid Industries is constantly looking for ways to further optimize costs. The company has identified a number of areas where costs can be reduced, including:

- Negotiating with suppliers: The company is negotiating with suppliers to reduce the cost of raw materials and other supplies.

- Improving efficiency: The company is implementing new processes and technologies to improve efficiency and reduce costs.

- Reducing waste: The company is implementing programs to reduce waste and improve productivity.

FAQ Insights

What is the significance of Asteroid Industries’ cost analysis?

Asteroid Industries’ cost analysis provides valuable insights into the company’s financial performance, cost structure, and areas for potential optimization, enabling stakeholders to make informed decisions and support the company’s long-term growth and profitability.

How does Asteroid Industries allocate costs to different departments or business units?

Asteroid Industries uses a variety of cost allocation methods to assign costs to different departments or business units, ensuring that costs are accurately and fairly distributed based on the resources consumed or activities performed by each unit.

What are some of the key cost control measures implemented by Asteroid Industries?

Asteroid Industries has implemented various cost control measures, including process improvements, vendor negotiations, and technology investments, to manage and reduce costs effectively, contributing to the company’s financial efficiency and profitability.